Insights

Global Outlook 2025: navigating unpredictability

Global Outlook Q4 2024: Cutting it fine

Bond index inclusion benefits India growth

US elections in the spotlight

Latest podcasts

Listen to Markets 360 | Global Markets podcast

Luigi Speranza, Global Head of Markets 360 and his team give you an overview of the latest market insights in short episodes.

Podcast on Spotify

Podcast on Apple

Discover Markets 360

Thought-leading strategy & economics

Gain unparalleled access to in-depth analysis and thought-leading strategy and economics. Beyond our ingrained European DNA, our on-the-ground teams across Asia-Pacific and the Americas deliver the latest, most definitive insights to help you make informed decisions as markets move.

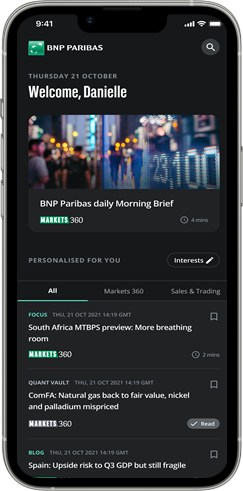

BNP Paribas Global Markets App

The app for a changing world

Broaden your perspectives by tapping into BNP Paribas’ views, analysis and daily insights from the Markets 360TM Strategy and Economics team and Sales & Trading desks – anytime, anywhere – and in a fully customised way!

A truly holistic view on markets

Quantitative DNA

Our Quant analysis across macroeconomics and the major asset classes uses in-house models and tools, including our renowned MarFA™, STEER™ and Cyclical-R frameworks. We use alternative data and the latest statistical techniques, regression analysis, machine learning and natural language processing to deliver quant and evidence-based analysis to our clients.

Read moreEmerging markets strength

We cover some of the most relevant Emerging Markets economies, with locally based teams in many of them. Our products set us apart, such as the benchmark election trackers that swiftly respond to economic and political events. We integrate all markets and drivers to avoid segmentation and partial views while challenging entrenched market views.

Read moreSustainability

Markets 360 embraces sustainability as a disruptor that is changing investment practice and we help clients to unlock value and mitigate risk. We examine key themes such as the carbon transition, ESG analysis, green bonds and the circular economy. In addition, we integrate sustainability analysis to our economics and strategy.

Read moreDerivatives proficiency

We have dedicated specialists covering volatility markets in the major assets classes. Aided by our quantitative tools, we provide in-depth and market-leading analysis of derivatives markets. Our analysis aims to improve the understanding of this apparently complex market among all investor types.

Read moreMy Morning Comment

Available to eligible clients, My Morning Comment gathers markets insights into one email, from Markets 360™ Economists and Strategists as well as Sales and Trading desks and provides a condensed view on the latest events to prepare for the day ahead. It enables clients to define their area of focus and receive content relevant to their selected choices.

Find out more and enquire here.

Read moreAccess Markets 360

Be the first to know

Every month, be the first to know about our latest publications

Awards

Events

Insights